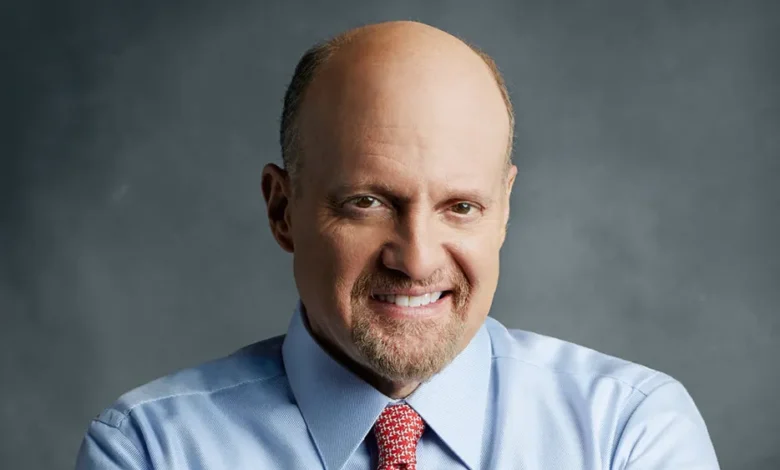

The Jim Cramer Playbook: Mastering the Market with Mad Money’s Maestro

Introduction: The Voice of Main Street Investing

Jim Cramer—CNBC’s fiery host of Mad Money and co-founder of TheStreet—has democratized stock market wisdom for two decades. With a career spanning hedge fund management, journalism, and financial education, Cramer blends theatricality with tactical advice, empowering everyday investors to navigate Wall Street’s chaos. His mantra? “You don’t need to be perfect at managing your money, you just need to be good enough” 1. This article unpacks Cramer’s philosophy, strategies, and tools, transforming market complexity into actionable intelligence.

1. Core Philosophy: Perfection Not Required

Cramer’s foundational principle rejects the obsession with timing every market fluctuation. Instead, he champions disciplined pragmatism. For part-time investors juggling careers and portfolios, his advice is clear: avoid reactive trading and focus on high-conviction stocks. Research underpins this approach—knowing each company’s fundamentals (earnings, debt, competitive positioning) allows investors to weather volatility without panic selling. When stocks surge, Cramer advises taking profits and deploying cash during dips, a strategy he calls “buying lower after selling high” 14.

Critically, he acknowledges that beating the S&P 500 requires time and temperament many lack. Thus, index funds form his safety net: “Never discount their power as a relatively easy way to make money” 1. This balance of active stock-picking and passive indexing defines his “good enough” ethos—aim for consistent growth, not infallibility.

2. Practical Strategies: A Disciplined Framework

Cramer’s methodology merges fundamental analysis, sector diversification, and strategic patience:

- Research-Driven Stock Selection: Investigate management quality, earnings reports, and industry trends. For example, his 2025 picks like Nvidia (AI leadership) and Eli Lilly (robust drug pipeline) reflect deep dives into innovation and financial health 4.

- Sector Diversification: Limit any sector to 20% of your portfolio. Tech stocks (e.g., CrowdStrike, Microsoft) may drive growth, but healthcare, consumer staples, and utilities provide stability during downturns 415.

- Risk Management by Age: Younger investors can embrace volatility for higher returns, but those nearing retirement should shift toward bonds and cash. Cramer himself reduced stocks to 40% of his portfolio at age 65 15.

- Insider Signals: Monitor executives’ stock buys—a legal indicator of confidence. If leaders invest heavily post-market dips, it often signals undervalued potential 15.

💡 Key Tip: “Wait for pullbacks before buying rising stocks. Overheated prices rarely sustain momentum” 15.

3. Mad Money: Education Over Entertainment

Beyond its sound effects and catchphrases (“Boo-yah!”), Mad Money is a masterclass in market literacy. Cramer’s mission—”to teach you how to think like a pro”—shapes segments like “Lightning Round” and “Am I Diversified?” The show dissects earnings reports, Federal Reserve policies, and geopolitical events, emphasizing context over tips 26.

Recent episodes highlight tariff impacts on tech stocks and inflation-resistant sectors—a real-time curriculum for 2025’s challenges. Viewers learn to ask: How did management execute this quarter? What macro forces could alter growth? 48. The goal isn’t entertainment; it’s equipping investors with a analytical toolkit.

4. Literary Legacy: Books for Every Investor

Cramer’s books extend his TV teachings into structured guides:

- Get Rich Carefully (2013): The definitive primer on spotting long-term winners (e.g., Amazon, Facebook) using earnings trends and leadership vetting 3.

- Stay Mad for Life: Focuses on generational wealth—mortgages, college savings, and retirement accounts—prioritizing stability over speculation 3.

- Confessions of a Street Addict (2002): A memoir exposing hedge fund pressures and psychological traps, humanizing market mechanics 37.

These works evolve with market eras—from dot-com mania (Real Money, 2005) to post-2008 recovery (Getting Back to Even)—proving Cramer’s adaptability 37.

5. CNBC Investing Club: Transparency in Action

Launched to democratize access, Cramer’s Investing Club mirrors his Charitable Trust portfolio. Subscribers receive:

- Real-time trade alerts (e.g., buys in AI or healthcare stocks).

- Weekly video analyses of economic data and earnings.

- Diversification “report cards” grading portfolio balance 46.

The club exemplifies Cramer’s open-book approach: “I play with an open hand to help you build long-term wealth” 6.

Conclusion: Empowering the Everyday Investor

Jim Cramer’s genius lies in demystifying finance without diluting rigor. By marrying index funds for stability with strategic stock picks for growth, his framework turns market participation into a sustainable practice—not a high-stakes gamble. As 2025’s volatility unfolds, his evergreen advice resonates: “Do what’s right for you.”

Frequently Asked Questions

Q1: Is Jim Cramer credible despite criticism of his energetic style?

Yes. His hedge fund delivered 24% annual returns pre-CNBC, and his books/CNBC platforms offer transparent, research-backed advice. Theatrics serve engagement; the substance prioritizes education 34.

Q2: How can beginners start with Cramer’s strategies?

Begin with index funds (40–60% of your portfolio), then add 3–5 stocks from sectors you understand. Use Mad Money episodes or Investing Club breakdowns to study rationale 115.

Q3: What are common mistakes Cramer warns against?

- Overtrading on daily news.

- Ignoring diversification.

- Changing strategies during corrections. “Stay disciplined; let your thesis play out” 14.

Q4: Does Cramer still recommend tech stocks in 2025?

Selectively. He favors companies with AI integration (Nvidia), cloud dominance (Amazon), and cybersecurity (CrowdStrike), but stresses valuation checks amid rate hikes 48.

Q5: Where can I track his latest stock picks?

Follow Mad Money (weeknights, CNBC), the CNBC Investing Club, or TheStreet.com 46.